As the weather warmed up this spring, so did the national housing market, shaking off a relatively sluggish start to the year to register the highest annual rate of home value appreciation in any second quarter since 2004.

The U.S. Zillow Home Value Index rose to $161,100 as of the end of the second quarter, up 5.8 percent year-over-year and 2.4 percent from the first quarter, the largest annual gain since August 2006 and largest gain in any quarter since the fourth quarter of 2005. National home values rose just 0.25 percent during the first quarter.

Additionally, not only did the pace of home value appreciation quicken in the second quarter, but the recovery also fully took hold nationwide. Markets in some areas of the Northeast, Midwest and Southeastern U.S. that had previously been slow to turn the corner began to appreciate, which helped boost the overall national market. All of the top 30 largest metro areas covered by Zillow experienced annual appreciation as of the end of the second quarter, and all have hit their bottom. Metros with the largest annual gains in the second quarter included Sacramento (29.5 percent), Las Vegas (29.4 percent) and San Francisco (25.5 percent).

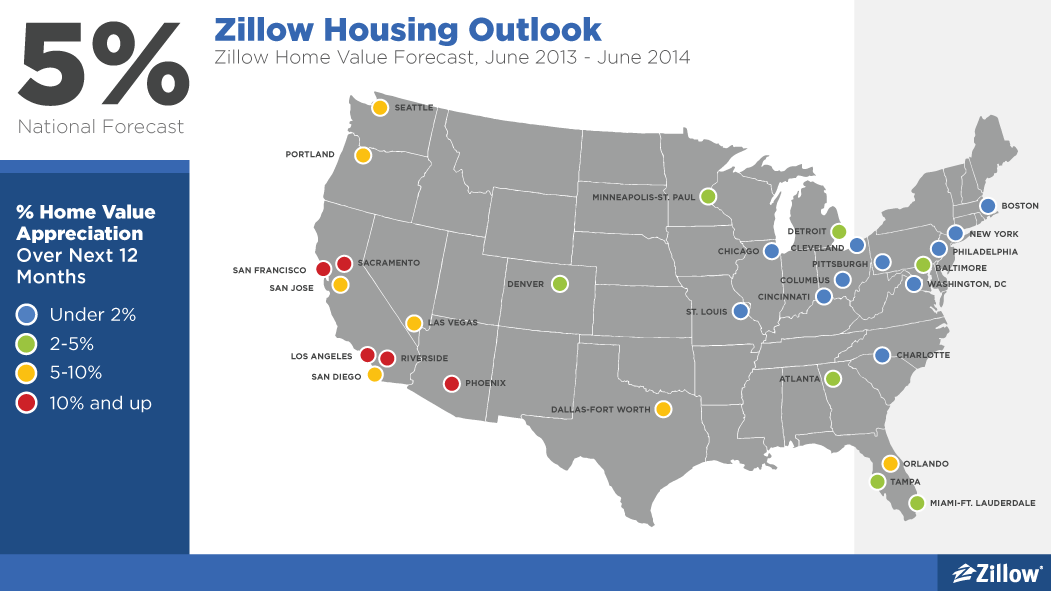

Home values are expected to rise another 5 percent over the next 12 months, according to the Zillow Home Value Forecast. Of the 30 largest metro areas, 29 are expected to show home value appreciation in the next year. Metros expected to see the highest appreciation rates through June 2014 include Sacramento (18.9 percent), Riverside, CA (16.6 percent) and Phoenix (11 percent).

Only the New York metro is expected to show home value depreciation over the next 12 months (-0.8 percent). One possible explanation for expected depreciation (however slight) in the New York metro area is because New York is a judicial foreclosure state, with all foreclosures requiring judicial review before completion, which can lengthen the foreclosure process. Because foreclosures take longer to work through the system, they continue to drag home value appreciation rates down, according to Zillow economists. This could also help explain why large metro areas in other judicial foreclosure states, including Pennsylvania, Ohio and Illinois, are expected to show only modest appreciation over the next year.

As home values continue to rise along with mortgage interest rates, and different kinds of buyers and sellers enter and exit the market, the landscape is expected to change.

“The U.S. housing market as a whole is currently not experiencing a bubble, but in many places it sure must feel like one, with some markets experiencing annual home value appreciation approaching 30 percent. Homeowners are feeling a sense of whiplash after years of depreciation, but this kind of market behavior won’t last,” said Zillow Senior Economist Svenja Gudell. “Investors are starting to pull out of some markets and regular buyers are coming back, and more inventory is slowly but surely coming on line, both of which will contribute to slowdowns in appreciation. Additionally, in some overheated markets, rapid home value increases coupled with rising mortgage rates will lead to housing prices and financing costs outpacing local income growth, which will also contribute to a moderation of the market. Combined, all of these factors will help the market in the second half of 2013 and beyond normalize and become much more steady than it has been in these past six months.”

In the rental market, national rents fell in the second quarter compared with the first quarter by 0.5 percent, to a Zillow Rent Index of $1,282, the first quarterly decline after nine consecutive quarters either increasing or remaining flat. Year-over-year, national rents rose 1.6 percent as of the end of the second quarter. This is a significant annual decline in the rental appreciation rate, which at its peak stood at 6.2 percent nationally in September 2012. This development combined with rising home values is another contributor to investors exiting some markets, as they had often bought for-sale inventory to convert into for-rent properties.

Foreclosure rates also fell in the second quarter compared with the first quarter. A total of 4.96 out of every 10,000 homes nationwide were foreclosed upon in the second quarter, down 0.7 homes per 10,000 from the first quarter and down 1.6 homes per 10,000 year-over-year.

For further analysis visit the Zillow Research Blog here.

via Zillow Blog - Real Estate Market Stats, Celebrity Real Estate, and Zillow News http://feedproxy.google.com/~r/ZillowBlog/~3/vo_j-OIRfx0/,www.greaterftmyershomes.com

No comments:

Post a Comment